How Grey Finance Has Helped My Biz: Geegpay vs Grey!

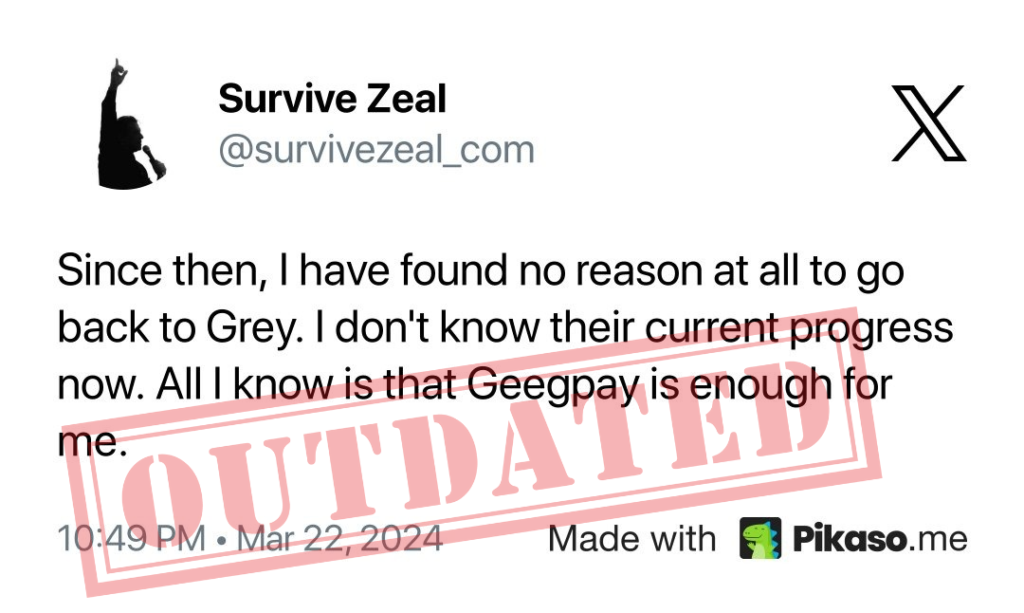

I remembered sharing my amazing experience with Geegpay, an alternative to the Grey platform in 2024.

I shared how I found Geegpay as an alternative when I was looking for a way to receive my USD payment.

At that time, Grey Finance didn’t yet support the kind of processing I needed.

So that’s how Geegpay hold me for a while. I performed series of transaction before returning to Grey Finance.

My writing “I haven’t found any reason to return back to Grey” finally became outdated.

I returned to Grey like the prodigal son who left a very beautiful place to an inferior habitation.

Now, this is not made up at all!

I am even surprised how I have those stories — Used Grey At First — Found Geegpay — Got Lost Using It — Later Found My Way Back To Grey.

It may be hard to believe. But that’s how it is.

Here’s how I returned to Grey.

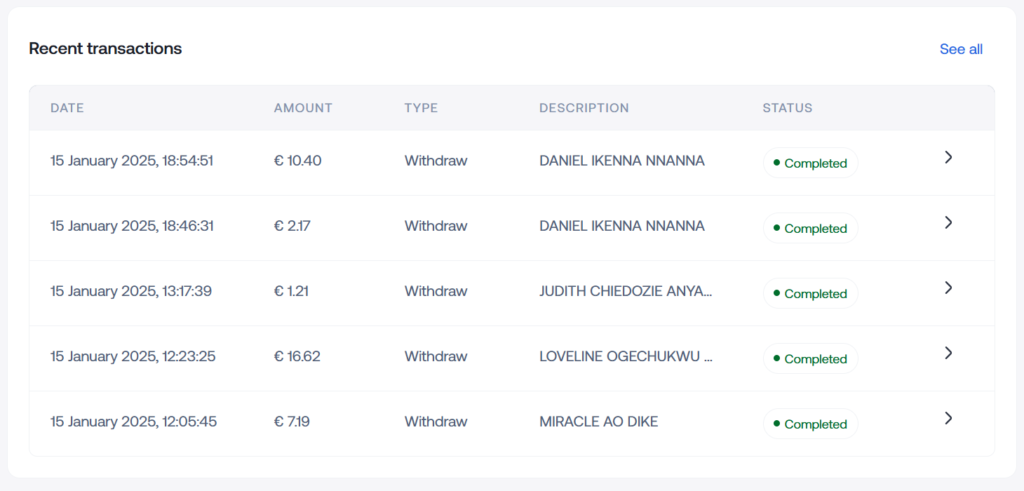

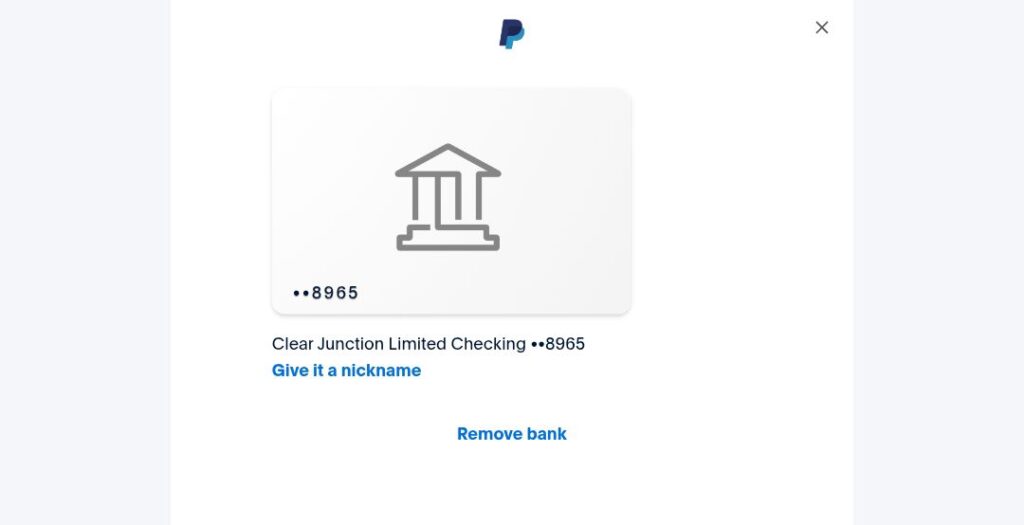

PS. Most of my transaction (last 3 months) was carried out using Grey. When I returned, I started using Grey more and more, mostly because their Bank Accounts got successfully linked to my PayPal. You can learn how to do this too – Paypal course for unrestricted countries.

This Is My Return to Grey 🩶

There are many reasons that caused me to return back to Grey.

The first reason was the success of the pairing (bank account) between PayPal and the Platform.

I had created several PayPal accounts from different locations to see if any would communicate well with my Geegpay Foreign Accounts. But none connected!

So I tried Grey. I used my Euro and GBP accounts and they were instantly connected.

That means I can now transfer my funds directly to my bank account, thereby evading fees from PayPal fund Exchangers and removing the associated risk.

Another reason that caused my return to Grey is that they support my PayPal fund exchange business.

Don’t worry, I’m coming to all of them properly. But do you know that when I haven’t found Grey, I used PayPal fund Exchangers like Koji?

But after finding it, it made me an Exchanger too. So I have followed those cool guys to take cuts from PayPal funds as profit. Powerful!

Not only does Grey serve me with seamless transactions, but I have also used them to run a business that gives me money.

Do you know why Geegpay wasn’t a great fit for my newly found exchange business?

Oops. I don’t think you know.

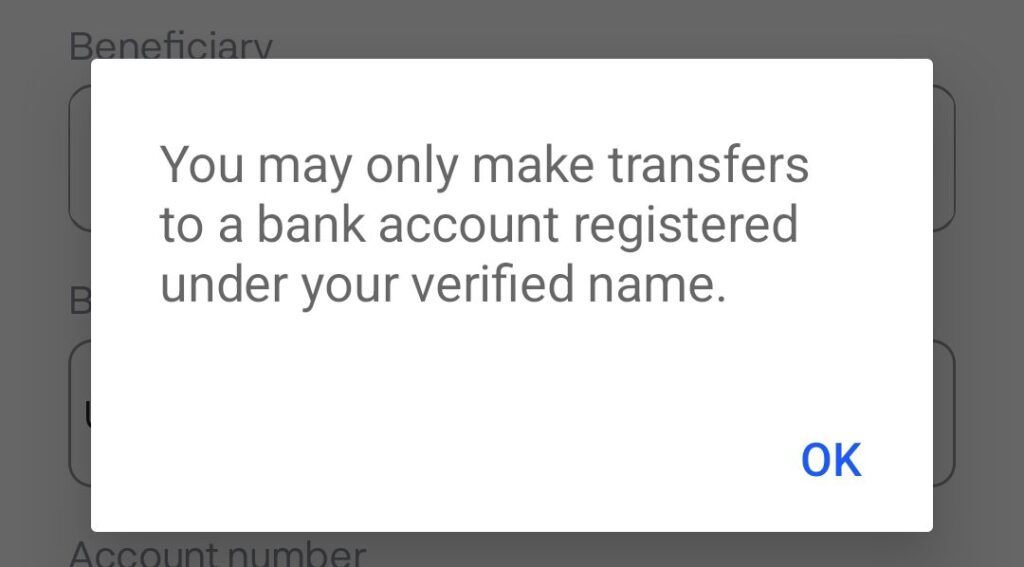

It’s simply because it doesn’t permit sending to others.

Consider Geegpay as kind of a personal platform that manages your things alone.

As opposed, Grey Finance lets me transfer to anyone I want regardless of location. Therefore, it is possible for me to send local currency equivalent (like the Naira) to those that I carried exchange business with.

Let me now quickly align the headaches Grey Finance has healed since I discovered it as a fintech platform.

The Headaches Grey Finance Solved For Me

Just like I wrote last year about the goodness of Geegpay, Grey Finance also cured the same headaches plus extra things that weren’t possible with Geegpay.

Let’s first look at the issues Geegpay solved that Grey solved better.

1. Theft Possibility During Currency Exchange (especially PayPal)

It’s highly possible to lose money during Currency Exchange. Even the ones you trust might deny your NGN equivalents after you have released funds.

!Important: I created SVZ Exchange to keep your funds safe at all times. You can even use an escrow service with us. You just need to find the ones that operate in your country. Or we help you with that – we deal internationally.

2. Charges from multiple sources

As opposed to PayPal, there’s little to no charge from Grey. The same also goes for the Money Exchanger Men I use online. They are always cutting out their profit from the actual value of my money. With Grey, the fees are negligible.

3. Poor CBN rates

We all know that the Central Bank rates for foreign currencies are always lower than the Market rates. You won’t have any issue using Grey, because they offer the biggest exchange rate. This means that your funds will amount to greater value when converted.

4. Poor Credit card service

If you’re using this platform, you no longer need a third-party app to cater to bill payment and online transactions. Grey’s Credit Card uses state-of-the-art security standards and is reliable.

5. High cost of foreign accounts

As far as Grey is concerned, their foreign accounts are free of cost. Therefore, you don’t need to spend a dime to acquire a foreign account. They offer USD, GBP, and Euro Accounts.

Grey vs Geegpay

Of course, the headaches that were solved above, Geegpay the competing platform also meet them well. It’s just that Grey Finance served them better.

For instance, when it comes to the supported countries, Grey supports a whole lot (88+) whereas Geegpay (a spanking new platform) merely supports 14 countries.

Another thing to note here is —

While Geegpay supports 14 countries, it’s perhaps not possible to transfer to accounts that you don’t own.

I have tried that several times, but Geegpay didn’t permit. I think it’s suitable for personal usage and not anything business-oriented.

Let’s now see those big advantages Grey Finance has over Geegpay that I managed to spot.

Grey Advantages

1. You can send to anybody unlike Geegpay which restricts only to yourself

You can make nationwide transactions with Grey. The platform currently supports over 80+ country.

You don’t have the same with Geegpay as it’s a new company and is natively built for personal usage.

2. Best for businesses

The fact you can send money to anyone across the border makes Grey best for business people.

The platform also has a high transaction limit which will cater to your biz need. Geegpay only lets you do $2,500 daily.

3. The Ability to send to others opened another earning means (for me 😉)

Because I can send to my Ghanaian friends, Indonesian friends, etc, my PayPal fund exchange business still works for people across the border.

If you’re wondering what my business is — it’s actually helping people receive their PayPal funds, especially those who haven’t successfully linked their Grey bank account to their PayPal.

So Grey opened that chance for me.

4. Miscellaneous/Others

There are way more other things that this #1 fintech company does, unlike Geegpay and others.

You get to enjoy airtime and data services. You have options to pay your bills. Whether it’s an electricity bill, cable TV bill, or even funding your betting wallet, the platform has fully got your back.

Conclusion

My journey with Geegpay and Grey was an intriguing one.

I had the chance to test both platforms and ascertain the best one for my type of business.

Grey, being very old (formally Aboki Africa) edged out Geegpay in every place.

I have returned to stay with Grey Finance. It will always be my first-choice fintech company to receive money.

Currently, it’s the only one that supports my PayPal exchange business.

Let me say this — If you’re contemplating going with Grey Finance or Geegpay, bear in mind that the formal will most likely meet your needs. Geegpay is just a small portion of the big platform Grey Finance.

Really Grey has transformed my life a whole lot.

>>> Take Grey Finance for a spin. Use my code DCLXSN lets win together.

Pro Tip: If you want to get rid of us (PayPal fund exchangers) and our cuts, get started with Grey! It gives best rate 😌🥳

I am also dropping Geegpay’s link LOL…

You can use both platforms to gain double foreign accounts 😉

>>>Double the game with Geegpay.

Use the code daninn9585. Don’t forget it please!

Stuck with PayPal funds you can’t withdraw? Let SVZ Exchange help!

📌 We receive PayPal payments on your behalf through our trusted pick-up service.

📘 We also offer practical courses on using PayPal legally from unsupported countries.