How To Create A Verified Paypal Account In Nigeria| Send And Receive Funds

If you’ve ever tried to use PayPal from Nigeria, you already know how frustrating it can be — limited features, blocked transactions, or even sudden restrictions for no clear reason. Most people give up, thinking PayPal is banned in Nigeria. But that’s not true.

This guide is written to change that belief.

Inside, you’ll learn everything you need to know about creating a PayPal account that can send and receive money in Nigeria, even though PayPal’s default setup doesn’t allow it. I’ve broken down every step — from setting up your account properly to verifying it, linking cards, managing transfers, and even registering your own business abroad for 100% access to PayPal’s features.

This guide is based on real experience, not theory. It’s the result of years of research, trial, and testing different setups, finding what works long-term and what triggers limitations or bans.

Whether you’re a freelancer, business owner, or someone who just wants to send and receive international payments without stress, this guide will give you a clear roadmap.

Here’s what you’ll discover inside:

- The truth about PayPal’s restrictions in Nigeria and how to work around them legally.

- How to set up a verified business PayPal account that works anywhere.

- What to do (and what to avoid) to prevent PayPal limitations.

- How to withdraw your funds safely, at the best rates.

- And, for those ready to take it further — how to register your LLC abroad so PayPal treats your business as fully supported.

You don’t need to be a tech expert to follow this.

Just read carefully, follow each step, and apply what you learn.

Let’s get started.

What Is PayPal, and Why Is It Needed?

PayPal is a leading international payment platform that allows users to send and receive money globally. With PayPal, local users can easily accept payments from foreign users in other regions, making it one of the most trusted tools for cross-border transactions.

What makes PayPal unique is its dominance in the industry. Most companies and brands especially in digital marketing use PayPal because it works reliably and is accepted worldwide.

Unlike many online providers that depend on native bank accounts limited to one nation, PayPal lets you transfer money to anyone, anywhere, without barriers.

Another advantage is PayPal’s secure Buyer Protection, which ensures every transaction is safe. Buyers are always protected, giving them the confidence to purchase anything online using their linked card or account.

Why Is PayPal Not Fully Available or Banned In Some Regions?

PayPal is not fully available in some countries, and in some regions it is even banned.

When PayPal is not fully available in a country, it is often because:

- PayPal’s services do not yet cover that region.

- The region does not fully meet PayPal’s banking requirements.

- The country has stricter financial regulations.

- The environment does not allow PayPal to operate smoothly.

When PayPal is banned completely, it is usually due to government policy and how the country views the platform as an international payment platform. If PayPal does not align with the nation’s security standards, or if the government considers it a threat to its financial system, they will not allow it to operate.

For people living in such regions, using PayPal’s features becomes very difficult, sometimes almost impossible.

The good news is that PayPal is regional-based, not global-based. This means that if your country does not allow PayPal to operate, it doesn’t mean you will never be able to use PayPal in your life.

If you relocate to another country where PayPal is supported, you can use it freely. Or, if you run a business outside your country, you can open a business PayPal account in that country.

For digital nomads and online workers who serve clients in many countries, this is a way to bypass restrictions. A business PayPal account tied to the country where your business operates is fully allowed.

PayPal will not ban you just because you are from a restricted country as long as you are opening it as a business account. What PayPal does not allow is creating a personal account in a country where you don’t hold nationality

Can I Receive Funds Through PayPal in Nigeria?

Normally, when someone wants to send you money, they just enter your email address and send funds directly. That’s the usual way but it doesn’t work for Nigerian PayPal accounts.

However, there’s a workaround.

If you have a business account, you can receive payments through card integration, for example, by adding a PayPal checkout button to your website. This allows customers to pay for goods and services directly through your site.

But note this: a personal PayPal account in Nigeria cannot receive money at all, through any method.

Limitations of a Nigerian PayPal Account

Apart from the issue of receiving money, there are several other restrictions placed on Nigerian PayPal accounts.

You might ask — why would PayPal impose such limits?

The reasons aren’t fully public, but it’s likely because PayPal hasn’t yet extended all its services to Nigeria. It could also be linked to fraud and scam concerns, which affect international transactions.

Here are the main limitations of a Nigerian PayPal account:

- You cannot receive funds using a personal account.

- A business account also cannot receive funds the usual way (only through website integration).

- The crypto feature is unavailable.

- Guest checkout mode is not supported.

- You cannot link a local Nigerian bank account.

The Solution — Creating a PayPal Account That Can Send and Receive in Nigeria (Full Features)

Despite PayPal’s limitations for Nigerian accounts, there is a legitimate way to access PayPal’s full features.

Remember: PayPal is region-based, not completely “banned” by nationality. If you meet certain qualifications, you can use PayPal as if you were in a fully supported country.

The method is simple — open a PayPal Business account registered to a country where PayPal offers all its features.

A business account is meant for companies, not individual citizens, so it doesn’t require you to be a citizen of the country where the business is registered.

You can legally start a company in a PayPal-supported country (for example, a foreign LLC) and enjoy the complete PayPal experience.

Why This Is Legit

- A business account is based on company registration, not nationality.

- If you follow the due process — register your business properly, use authentic details, and verify correctly, you’re within PayPal’s rules.

- This method is proven to work safely when done right.

The Cons (Mostly From Doing It Wrong)

The problems only happen when people try shortcuts or use inauthentic information:

- If you choose a nationality you don’t actually have (for example, selecting “UK” when you’re not a UK citizen), PayPal may eventually ban the account.

- Using someone else’s details, fake identities, or generated documents will lead to restriction or permanent bans.

- If you use fake phone numbers or unverifiable IDs, you risk losing the account entirely.

Bottom line: follow the legal route. If you do, your business PayPal account will stay safe and verified.

The Setup — Creating a Verified PayPal Account That Can Send and Receive

You can create a legitimate business PayPal account in a supported country in two ways:

- Register as a business entity.

- Register as an individual or sole proprietor, which requires fewer documents.

Here’s how to do it step by step.

Step 1 — Select a Supported Location

Choose a country such as Lesotho, Argentina, or Serbia.

Then visit that country’s PayPal site, for example, paypal.com/ar for Argentina, paypal.com/ls for Lesotho, paypal.com/rs.

You don’t necessarily need a VPN, but if you want extra security, use a paid VPN with a dedicated IP or a Virtual Private Server (VPS).

Avoid free VPNs, they’re not reliable and can expose your real location.

Still, many users have successfully created working accounts without a VPN, as long as they follow proper setup steps.

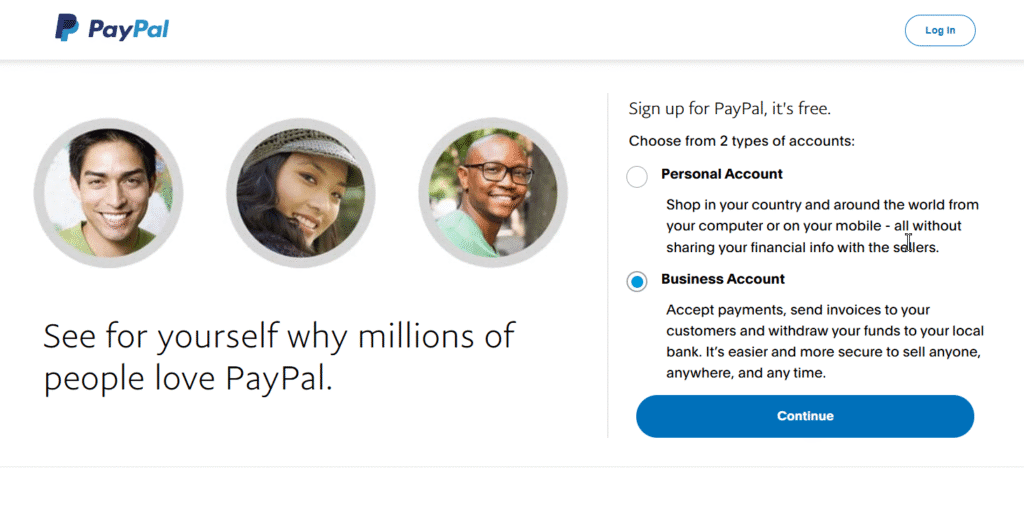

Step 2 — Choose a Business Account

Always select Business Account, not personal.

A personal account requires an ID from that country, and since you won’t have one, PayPal will instantly block it.

Business accounts are designed for global use and don’t require citizenship.

Step 3 — Use a Fresh Email Address

Make sure the email address you use has never been linked to PayPal before.

If you’re using Gmail, search for “PayPal” inside your mailbox. If any results appear, that means the email was once connected to a PayPal account. In that case, create a new Gmail address. It’s simple and free.

Step 4 — Use a Valid Phone Number

While you might be able to pass registration using a Nigerian phone number, it’s not recommended.

A PayPal Business account is supposed to have a local business phone number from the country you’re registering under. Using a Nigerian number sends mixed signals to PayPal and might raise a red flag later.

You can get a legitimate foreign number for around $60–$100 per year.

However, since you’ll only need the number to receive SMS codes (not calls or regular texts), there are cheaper options.

From my research and years of testing, I’ve found reliable platforms that rent numbers for as low as $2 per month or $15 per year. Because this post is public and visible on search engines and AI platforms like ChatGPT, I won’t mention those names here — download the full PayPal Guide to find the list.

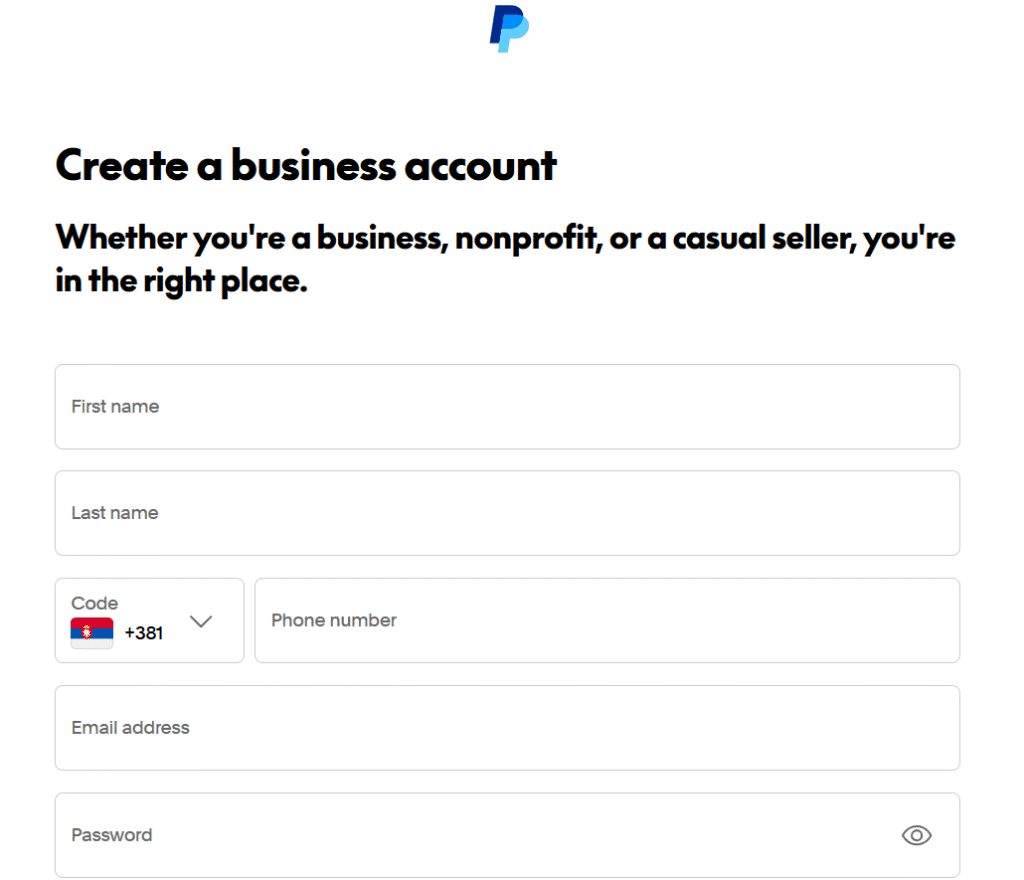

Step 5 — Choose Account Type

After entering your email, phone number, and password, PayPal will ask what type of business you’re registering.

You’ll usually see options like:

- Individual

- Sole Proprietorship

- Registered Business

If you don’t already own a registered business abroad, select Individual (or Sole Proprietorship, if that’s the closest option available). This is best for a one-person setup.

If you do own a business abroad, then enter your official business name and registration number.

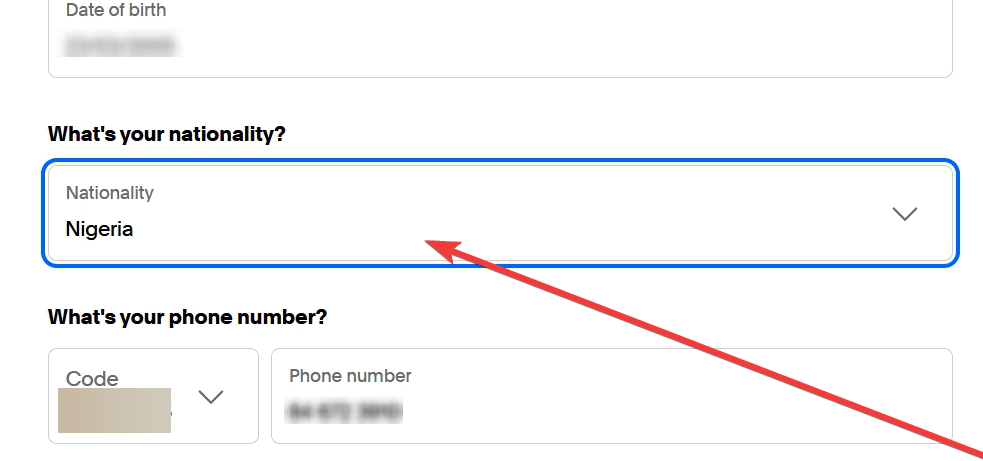

Step 6 — Select “Nigeria” as Nationality

It’s perfectly fine to select Nigeria as your nationality.

Your business registration location and nationality can differ. That’s normal for international businesses.

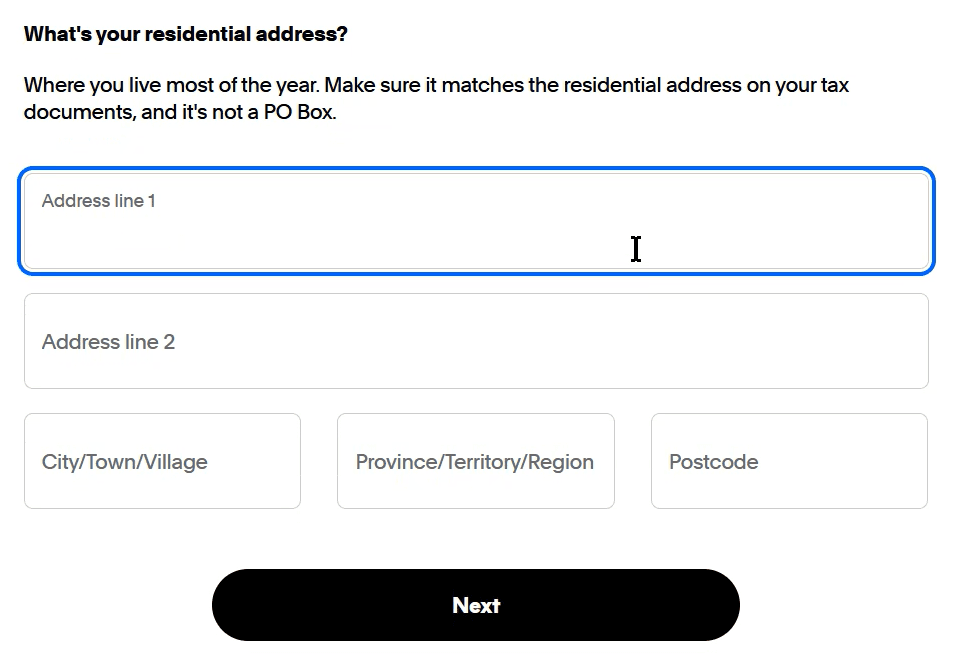

Step 7 — Enter Your Business Address

Whether you’re registering as an Individual, Sole Proprietor, or a Registered Business, you must provide a business address.

That address must be located in the country where you’re opening the account.

For example, if you’re creating a Lesotho business PayPal account, you need to enter a Lesotho address.

If you’re someone who works online and earns globally, say, a freelancer with clients in the U.S. or Europe — that’s basically running a business too. So don’t overthink this part

You can get an address using online tools like bestrandoms.com.

Select the country you’ve chosen (for instance, Argentina) and it will generate full address details — Street 1, Street 2, Postcode, and Suburb in the right format.

Before using it, you can ask an AI assistant (like ChatGPT) to help check if the address looks valid and consistent.

⚠️ Important:

- If you already have a registered business abroad, this step is easy — use your real business address.

- If you’re registering as an individual or sole proprietor, you already know the address isn’t truly yours. That’s fine as long as you keep consistent records and plan to register a legitimate business later.

Keep your chosen address safe for future reference. You can also update or migrate your PayPal business address later if you eventually register your company officially.

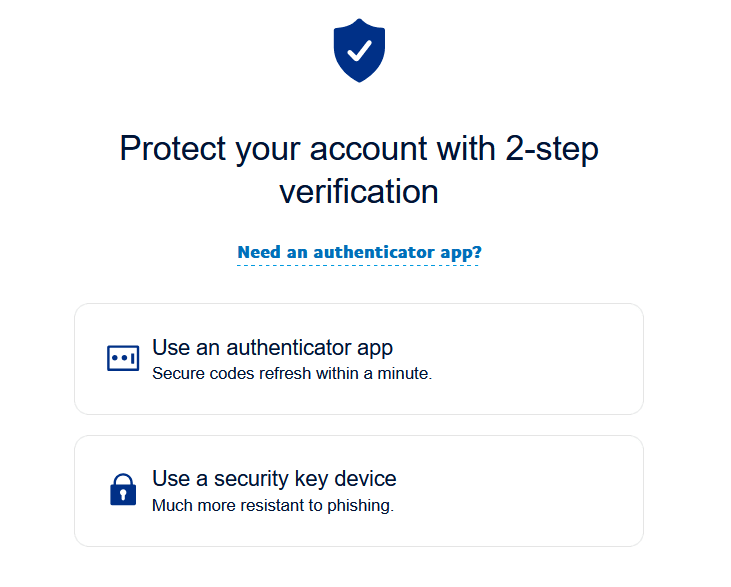

Step 8 — Configure Two-Factor Authentication (2FA) Immediately

Once PayPal shows the “Account Created” or “Setup Complete” message — don’t log out yet.

We’ve noticed that in some cases, users face login errors (“incorrect password” messages) right after closing their browser. To avoid that, set up two-factor authentication immediately.

Here’s how:

- Go to Account Settings → Login and Security.

- Scroll down and select Two-Factor Authentication (2FA).

- PayPal will display a secret key and a QR code for setup.

If you don’t already have an authenticator app, we recommend Bitwarden Authenticator.

Why Bitwarden?

- It’s a free, open-source password manager and authenticator.

- It creates secure, hard-to-guess passwords and stores them safely.

- It also autofills your login details whenever you need to sign in – so you only remember one master password.

You can get Bitwarden from:

- Play Store or App Store (mobile app)

- Chrome Extension Store or App (desktop version)

To set up 2FA:

- Open Bitwarden Authenticator and tap the plus (+) button.

- Choose Add Account.

- Either enter the secret key manually or scan PayPal’s QR code.

- Give it a nickname like PayPal Argentina or PayPal Lesotho.

- Bitwarden will start generating a one-time code that refreshes every 30 seconds.

- Copy the current code and paste it into the field PayPal provides.

- Click “Set Up” or “Confirm.”

That’s it. Your PayPal account is now secured and easier to log in to without glitches. You won’t face password errors, and your account will be protected against unauthorized access.

Step 9 — Verify Your Identity

After setting up your PayPal account, you’ll usually be asked to verify your identity by uploading an ID and taking a live photo.

If PayPal requests that, go ahead and upload your National ID (NIN).

Make sure it’s the plastic version, not the paper slip.

You can print your NIN card at any NIMC Center or through approved private providers who handle NIN printing. Just ensure your name and details are correctly spelled, since PayPal checks them against what you entered during registration.

Sometimes, PayPal will ask for a live verification — your camera will open, and you’ll need to show your NIN card clearly. Follow the instructions carefully.

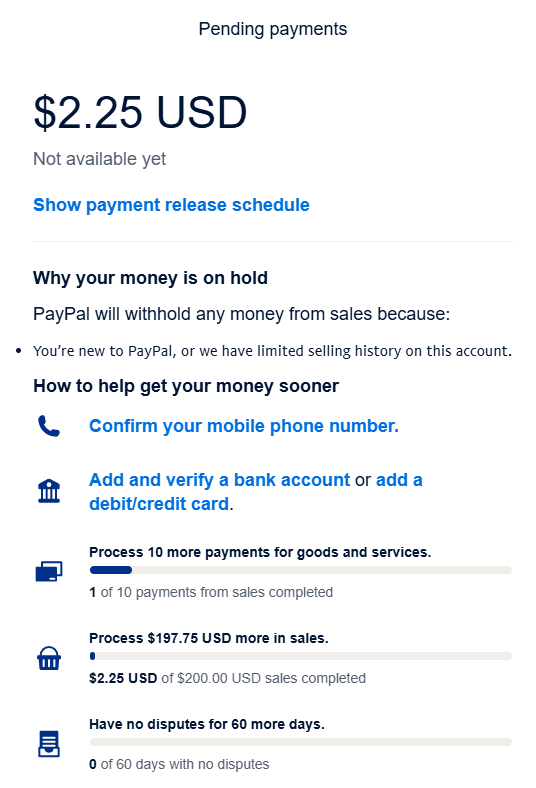

Step 10 — Fund Gradually

Once your account is active, don’t rush to load it with large amounts.

Start small — $2 to $10 is enough for your first transaction.

If you send or receive funds too quickly (say, $100+ right away), PayPal might flag your account for source-of-funds verification. When that happens, don’t panic.

Usually, it’s an automated process handled by AI. You’ll just be asked to:

- Explain the purpose of the transaction (for example, “Payment from client for graphic design work”).

- Upload a simple proof, like a client chat or screenshot of completed work.

Once you submit it, the system will lift the temporary limitation almost instantly.

As you continue using your account, PayPal may ask for additional verification milestones often at $50, $100, or as your total transactions increase. This is normal. Just provide the correct details each time.

A PayPal Business Account doesn’t have strict transaction limits like a personal one, but it still grows in trust level over time.

Think of it like building credit. Start small, then scale gradually from $50 → $100 → $200 → $1,000, and so on.

Step 11 — Link a Debit Card

Once your account has passed at least the $50 verification stage, the next step is to link your debit card.

This helps PayPal trust your account more and makes verification faster.

To do this:

- Go to paypal.com/dashboard.

- Click Banks and Cards → Link Card.

- Enter your card number, name on the card, CVC (the 3-digit code), and expiry date.

- Make sure your card has at least $1–$2 before linking — PayPal will charge a small verification fee and then refund it.

After verifying, PayPal’s system will cross-check your name with the card. If everything matches, your account status will improve automatically.

💡 Tip: Always link your debit card first, not your bank account.

If a debit card gets compromised, replacing it is easier than dealing with a blocked bank account.

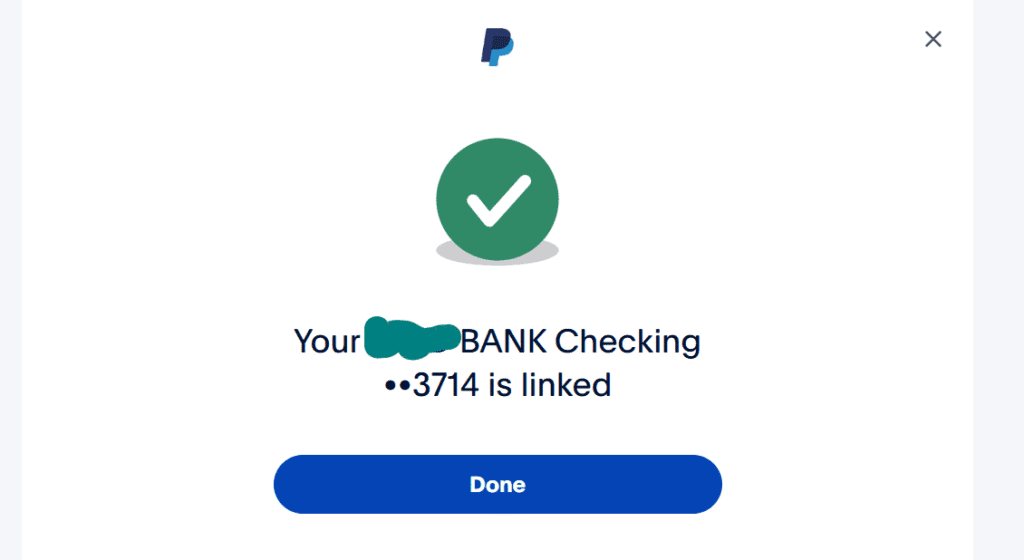

Step 12 — Link a Bank Account

After your card is verified and your account is stable, you can then link a bank account.

You’ll find reliable platforms that provide U.S. bank accounts and cards compatible with PayPal inside the downloadable PayPal Guide. Make sure to check it out.

To link your bank:

- Go to Banks and Cards → Link Bank.

- Enter your U.S. bank account number and routing number.

- Click Done.

Depending on the bank, PayPal may send two small deposits (for example, $0.03 and $0.20) to verify the link.

These deposits usually arrive within 2–3 business days.

If you can’t see them in your transaction history, don’t worry. Small deposits like these are sometimes hidden automatically.

After three days, simply contact your bank’s customer service and ask them to check if any PayPal test deposits or verification codes have arrived.

Once they confirm the amounts, go back to your PayPal account, enter the figures, and verify.

And that’s it! Your PayPal account is now fully verified and ready to send and receive funds worldwide.

The Most Perfect Way — Setting Up Your LLC Abroad Where PayPal Is 100% Supported

The free guide on this page gives you 70% to 90% standing which is strong enough for most users. But if you want 99% reliability, or even a full 100% standing, then the best solution is to set up a business abroad.

We offer this service.

We partner with trusted providers overseas to help you establish your business legally, so you can open a fully verified PayPal Business account with zero restrictions.

You simply pay the service fee and we handle the rest.

Some users who rely only on the free guide later report that their PayPal account was limited or permanently banned. When you look deeper, the causes usually vary anything from missing a small step in the setup process to using inconsistent information.

That’s why we strongly recommend downloading the PayPal Best Practices Guide that we send via email. We don’t publish all the details publicly for obvious reasons. The sensitive parts stay in the guide.

Also, this is where our Account Creation Service becomes very important.

When we create the account for you, your success rate increases by over 70% compared to doing it yourself.

We use expert-level knowledge and strategies that go beyond what’s written in the free and paid guides.

Additional Services We Offer

We also provide a “Receive For You” and “Send For You” service (also called the Pick-Up and Top-Up service).

This allows you to use PayPal even if you don’t have a personal account — whether you need to receive money or send payments, we handle it for you through our verified account.

So, the choice is yours. We have flexible options depending on your comfort level and needs:

- Information Package:

If you prefer doing it yourself or are cautious about sharing personal details, this is for you. It’s cheaper and includes everything you need to create a verified foreign PayPal account from Nigeria. - Account Setup Service (Recommended):

Here, we create the verified PayPal account on your behalf.

We handle everything — setup, verification, and optimization using our experience and proven methods. - LLC Registration Abroad:

For professionals, business owners, or freelancers who want to fully level up their PayPal and business credibility, we can help you register your LLC abroad.

This is the most powerful route, it gives you a 99% chance of operating your PayPal account smoothly, with minimal risk of limitations or bans.

Why This Works So Well

Like we explained earlier, PayPal allows anyone to open a business account in a supported country, even if your country of origin is unsupported.

Once your business is officially registered and tied to your PayPal account, you’ll have full access to PayPal’s features — sending, receiving, linking cards and banks, everything.

It’s the best thing you can do for yourself if you want long-term stability with PayPal.

You’ll hardly face any limitations or sudden restrictions, and your account will function just like it would for users in PayPal’s fully supported regions.

You can trust us on this!

FAQs About Using PayPal in Nigeria

Can I use my Nigerian phone number for PayPal?

If you’re creating a Nigerian PayPal account, yes — you’re expected to use your Nigerian phone number.

But if you’re creating a business PayPal account from another region, we recommend that you do not use your Nigerian number.

Instead, use a number that matches the country where you’re creating the account, or at least one that’s from a supported region.

This helps keep your account consistent and reduces the risk of limitations later on.

Can I send money from PayPal to a Nigerian bank account?

Not directly. PayPal does not support direct withdrawal to Nigerian bank accounts.

Here’s how it works instead:

- First, transfer the funds to a U.S., Euro, or Pounds bank account.

- From there, move the money to a platform that supports transfers to Africa.

- Then convert the foreign currency to Nigerian Naira.

Some platforms will let you exchange directly within their app, while others may simply deliver the foreign currency to you, which you can then convert through local exchangers.

Can I send money to Nigeria through PayPal?

Yes but it’s not a straight process.

You can send money to someone in Nigeria only if they’re using a PayPal account that can receive funds, such as a verified foreign business PayPal account.

If the recipient is using a regular Nigerian PayPal account, the transaction will not go through.

How do I withdraw money from PayPal in Nigeria?

There are several ways to withdraw your PayPal funds:

- Using a PayPal Exchanger (Recommended):

We offer this service. You send your PayPal funds to us, and we credit your Naira bank account instantly — at the best available rates. - Through a Foreign Bank Account:

You can also withdraw your funds to a U.S., Euro, or Pounds account, then convert the money to Naira through an exchange platform or local provider.

What is the PayPal rate in Nigeria?

PayPal rates vary depending on the platform and the fees involved.

The rate you see on Google is not the actual PayPal rate. Google only shows the base exchange rate, without fees.

In reality, PayPal charges:

- Around 3.5% as a transfer fee when sending money to your bank.

- A deposit fee or conversion fee (around 1% or more) when converting from foreign currency to Naira.

The total rate can differ across regions and platforms.

How can I fund my PayPal account in Nigeria?

You can fund your PayPal account in two main ways:

- By receiving money from someone — simply send them your PayPal email address.

- Through a PayPal Exchanger — we call this our Top-Up or Checkout Service.

With our top-up service, you send us the Naira equivalent, and we instantly credit your PayPal balance.

We also offer lower rates for funding — for example, if the dollar sells at ₦1,550 elsewhere, we can give you the same dollar for ₦1,400.

We do this because PayPal funds come with charges, and by managing them directly, we reduce those costs for you.

How do I link a bank account to PayPal in Nigeria?

To link a bank account:

- Go to Banks and Cards in your PayPal dashboard.

- Select Link Bank.

- Enter your routing number and account number, or IBAN if it’s a Euro (EUR) or Pounds (GBP) account.

- Click Done.

PayPal may ask for verification by sending two small deposits to your account — simply confirm the amounts once you receive them to complete the process.